By Jer Ayles-Ayler: Trihouse. The Team at Loans.org is smart. From a marketing/branding perspective, infographics get a lot of play these days. When done well, like this one, it’s easy to get Bloggers and media outlets to Tweet, Like and link…

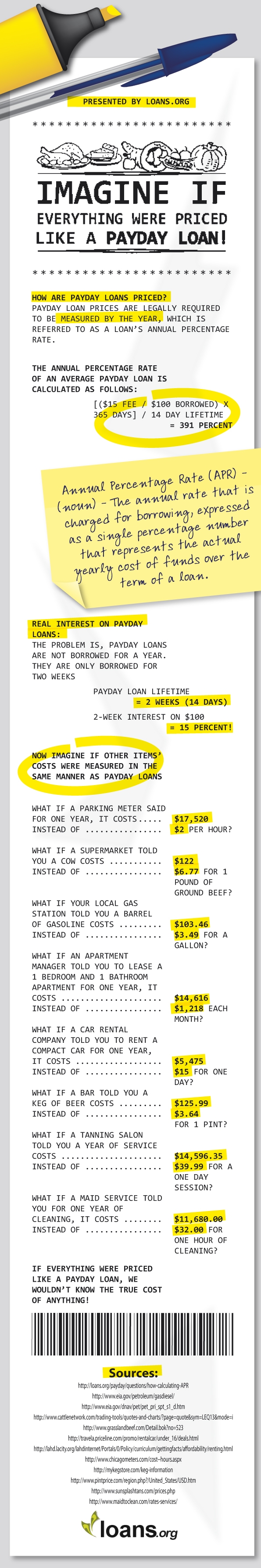

Infographic created by loans.org

THE BLOG

Jul

Jul

LPR (License Plate Recognition) technology plays a pivotal role in reducing car title lending defaults and expedites asset recovery. LPR use benefits our car title loan operators as well by reducing our fixed and variable costs; enabling lenders to charge lower fees to consumers experiencing a temporary financial challenge.

LPR (License Plate Recognition) technology plays a pivotal role in reducing car title lending defaults and expedites asset recovery. LPR use benefits our car title loan operators as well by reducing our fixed and variable costs; enabling lenders to charge lower fees to consumers experiencing a temporary financial challenge.

An LPR camera solution, employed by an asset recovery specialist, enables the repossession of vehicles when the title loan borrower defaults on a loan . License plate recognition technology also contributes to lower insurance and interest rates for car drivers and owners.

Additionally, LPR provider Vigilant Solutions, “Has documented over 750,000 instances where their vehicle location data helped public safety officials in criminal investigations involving murder, rape, kidnapping, terrorism, assaults, and crimes involving children.” Digital Recognition Network (DRN), “Has helped recover over 190,000 vehicles worth over $1.3 billion.

If you’re a car title loan lender and not yet using LPR technology, it’s time to get on board. Do the research, understand the benefits and improve your profitability.

Jul

“A 30-day, $250 loan from LendUp carries a fee of $44, about half the rate offered by competitor payday lenders in California, says Orloff. Over time, LendUp aims to transition responsible borrowers into a 2 percent monthly interest rate loan that can be reported to a credit union or bank. The information helps borrowers establish a credit history, which will help allow them to qualify for bank loans in the future.”

Read this piece here: National Journal and more at American Banker (Subscription required)

Jul

Payday lenders covered by FTC Act even if affiliated with American Indian Tribes

- By Lesley Fair

In an FTC action challenging allegedly illegal business practices by a

payday loan operation affiliated with American Indian Tribes, a United States Magistrate Judge just issued a report and recommendation on the scope of the FTC Act. Attorneys will want to give the order a careful read, but here’s the need-to-know nugget: Over the defendants’ vigorous opposition, the Magistrate Judge concluded that the FTC Act “gives the FTC the authority to bring suit against Indian Tribes, arms of Indian Tribes, and employees and contractors of arms of Indian Tribes.” Most importantly, the Judge’s finding confirms that the FTC’s consumer protection laws apply to businesses regardless of tribal affiliation. The FTC sees that as a key step in protecting consumers from deceptive and unfair practices.

The FTC sued a web of defendants — including AMG Services, Inc., 3 other Internet-based lending companies, 7 related companies, and 6 individuals, including race car driver Scott Tucker and his brother Blaine Tucker — for violating Section 5 of the FTC Act, the Electronic Fund Transfer Act, and the Truth in Lending Act in their payday loan practices. Some of the defendants tried to get the FTC case dismissed, claiming that their affiliation with American Indian Tribes makes them immune from those federal statutes.

Not so, urged the FTC. True, the FTC Act makes no specific reference either way to its applicability to tribal entities. But citing Supreme Court and Ninth Circuit precedent, the FTC reasoned that “statutes of general applicability that are silent on tribal issues presumptively apply to tribes and tribal businesses.”

The defendants responded that the FTC Act isn’t a “statute of general applicability” because Congress wrote certain exemptions into the law.

“Exemptions alone aren’t dispositive,” said the FTC, quoting the Ninth Circuit’sChapa De case. As the Court held in Chapa De, “The issue is whether the statute is generally applicable, not whether it is universally applicable. We have previously held that other federal statutes that contain exemptions are nevertheless generally applicable.”

Citing that decision and others, the Magistrate Judge’s report and recommendation rejected the defendants’ immunity theory and concluded that “the FTC Act has a broad reach and is one of general applicability.” The order reserves judgment on whether the defendants are “not for profit” corporations for purposes of the FTC Act, but held that TILA and EFTA apply regardless of the defendants’ disputed for-profit status.

The Magistrate Judge’s report and recommendation is now subject to review by United States District Judge Gloria M. Navarro.

A related update: The FTC reached a partial settlement with the principal defendants in the case. Under the terms of the order, those defendants will be barred from using threats of arrest and lawsuits as a tactic for collecting debts, and from requiring all borrowers to agree in advance to electronic withdrawals from their bank accounts as a condition of getting credit. The FTC continues to litigate other counts against the AMG defendants, including that they deceived consumers about the cost of their loans by charging undisclosed charges and inflated fees.

Jul

Allen Parker:Commentary on Sovereign Immunity and Tribe Owned Payday Loan Businesses

Posted by ConsumerLoanConsultant / Uncategorized

By: Allen Parker. Consultants4Tribes.com

While not an attorney, I have been introducing tribes and lenders for almost two years. The Magistrate’s ruling supports several points I’ve made on my blog, consultants4tribes.com, during those two years.

Namely:

Notwithstanding the fact that the sovereign immunity of federally recognized tribes extends to their wholly-owned lending businesses, those businesses must comply with federal consumer regulations whether operated in-house or contracted out. The defendants violated “…Section 5 of the FTC Act, the Electronic Fund Transfer Act, and the Truth in Lending Act in their payday loan practices,” all federal consumer regulations.

Sovereign immunity does not extend to lenders that manage the tribally-owned businesses. From a lender’s perspective, the primary benefit of working with a tribally-owned business is that the business is exempt from complying with state regulations, not those of the federal government.

Sovereign immunity does not extend to tribal members, only tribally-owned businesses. As best as I can tell, the Magistrate’s decision did not challenge the concept of sovereign immunity. It simply underscored the fact that tribally-owned lending businesses must comply with federal consumer regulations.

Allen Parker, President

Consultants4Tribes.com