“37% of Texas consumers said they could not cover a $400 emergency with current savings.”

[This stat varies depending on who paid for the study and their agenda, the specific state, etc.]

[Excerpts from the 2023 Texas OCCC, which regulates payday loans, car title loans, Texas CABs… Link at bottom]

In Texas, small consumer loan originations (342-F) have declined 30% since 2019.

Regulatory tightening lending standards, as lending costs rise, could also limit the availability of small-dollar loans.

Three of the most common credit products offered by licensees of the OCCC are motor vehicle retail installment sales, small installment consumer loans, and large installment consumer loans.

These products have rate ceilings and fee limitations and generally cannot pass on market increases to borrowers.

When the cost of borrowed funds (evidenced by the federal funds rate) and operating expenses (inflation) increase, lenders must make decisions as loans become less profitable.

Economic theory and consumer lending studies point to credit rationing or lower availability, especially to riskier borrowers, when market rates approach rate ceilings. (Vandenbrink, 1982) (Garon, Braga, Oglesby-Neal, & Martire, 2023)

Lending Volumes Non-real estate loans account for most consumer loans (Installment Loans, Pawn Loans, and Payday/Title Loans).

OCCC licensed lenders and financial service providers profiled in this report made 12,310,0003 loans for $10.8 billion in 2022.

This number does not reflect the number of borrowers as they may take out several loans during a year by refinancing a loan or receiving multiple loans throughout the year.

Texas Credit Access Businesses (Payday and Title Loans) Chapter 393

Overview

Credit access businesses (CABs) obtain credit for a consumer from an independent third-party lender in the form of a deferred presentment transaction or a motor vehicle title loan, more commonly referred to as “payday loans” or “title loans.”

In Texas, the actual third-party lender is not licensed; the credit access business that serves as the broker is the licensee in this regulated industry.

Credit access businesses charge a fee to the consumer for obtaining a third-party loan.

Fees are usually calculated as a percentage of the loan amount, either paid at the loan’s inception or accrued daily while the loan is outstanding.

All payments are made directly to the CAB, and the borrower will generally not have direct contact with the lender.

The CAB provides the borrower with a check for the proceeds issued from the lender’s account.

Borrowers can obtain these loans in high-traffic areas and increasingly online.

Type of Customer

Payday loan customers need an active bank account, and lenders will advance money to the consumer based on the expectation that money is regularly deposited in that bank account.

Title loan customers must have an unencumbered motor vehicle title to offer as security.

Both types of customers could have average to poor credit scores and choose these loans for convenience or eligibility reasons.

Typical Rates

The majority of the loan cost is not capped.

Fees charged to borrowers by the CAB typically depend on the amount of the loan and the length of the term.

CAB agreement terms are limited to 180 days or less. The entire loan may be due in a matter of days, or the loan may be due over several equal payments.

Refinancing or renewing payday and title loans is very common and can add to the cost.

Default Borrowers utilizing title loans risk losing their motor vehicle to the lender or the CAB.

The loan is usually guaranteed by the CAB, and the borrower will be pursued for the deficiency balance.

Creditors may file suit against the borrower for non-payment, and some may report the repayment history to consumer reporting agencies.

A borrower may also face attorney fees, repossession fees, and court costs added to the loan balance.

The prevalence of motor vehicle repossessions in the CAB industry is reported by quarter and has typically totaled 8,000 to 12,000.

However, total repossessions in Q1 2020 peaked at about 13,100. This number fell significantly in Q2 2020 as creditors worked with borrowers at the height of the coronavirus pandemic.

Many people lost their jobs; however, federal stimulus and loan forbearance played a large role in limiting Q2 repossessions.

Since the beginning of the pandemic, total repossessions have fluctuated from quarter to quarter, and repossessions as a percent of active title loans have continued to remain higher than historical norms.

Since borrowers may obtain multiple loans throughout the year, the repossession rate reflects the likeliness on a transaction basis, not a borrower basis.

Alternatives Payday and title loan borrowers generally pay a high rate for their credit and may run into eligibility issues with other products.

Possible alternatives are pawn loans, small installment loans, employer loans, or other competitive small-dollar loan products sometimes offered by credit unions or nonprofit organizations.

Data Limitations

The reported loans made have decreased in this industry since 2019, and factors specific to industry are likely a more significant cause than the COVID pandemic.

CABs are a specific subset of a broader classification of businesses registered as Credit Service Organizations (CSOs) with the Texas Secretary of State.

In 2019, the Attorney General of Texas opined that CSOs that are not CABs can still arrange extensions of credit for consumers so long as they are not deferred presentment transactions12 or motor vehicle title loans. (Attorney General of Texas, 2019)

CSOs that are not CABs might not: (1) obtain OCCC licenses, (2) receive OCCC compliance exams, and (3) report transaction data to the OCCC.

Additionally, the transaction has evolved from a predominantly single-payment loan with multiple renewals to one installment loan with the term and renewal equivalent to multiple loans.

Credit Access Business (CAB) Annual Data Report, CY 2022

The summary below represents aggregated statewide annual data reported by credit access businesses (CABs) as of 3/15/2023.

The OCCC reviewed the data for reasonableness.

The OCCC continues to receive amended or corrected data submissions, and periodic revisions are published when significant.

The OCCC will request verification from the licensee of any data found to be questionable or unreasonable.

Title 7, Section 83.5001 of the Texas Administrative Code requires CABs to file annual data reports with the Office of Consumer Credit Commissioner (OCCC) identifying loan activity associated with:

- single and installment deferred presentment (payday) loans, and

- single and installment auto title loans.

Data Limitations

Data provided by reporting CABs reflects location-level activity for the identified year.

Each licensed location is treated as an individual reporting unit. If data was compiled from individual customers, it could produce different results.

The data presented in the following summary represents CAB submissions via electronic and manual reporting (including any corrected data) of annual activity as of March 15, 2023.

Emergency or Unexpected Credit – Purpose and Amount

Since 2013, the Federal Reserve has conducted surveys on the likelihood that an American adult could pay for an unexpected $400 expense with cash or its equivalents.

In 2021, a record high number (68%) reported they could cover the expense with cash or its equivalents. However, a year later, the survey found consumers were doing noticeably worse, with only 63% reporting they could cover a $400 expense and 18% saying the most significant expense they could cover was less than $100 with current savings. (Board of Governors of the Federal Reserve System)

Lending Club Corporation, in partnership with PYMTS conducted a similar survey and concluded that the static $400 metric used by the Federal Reserve was not relevant for the types of expenses consumers face today. (PYMNTS and LendingClub Collaboration, 2022)

Their survey found that the average emergency expense is roughly $1,400, with car repairs being the most common.

4-WAYS I CAN HELP YOU!

Grab a copy of our “bible:” Learn More

Brainstorm: Learn More

The Business of Lending: Learn More

Free Bi-Monthly Newsletter: Learn More

Installment Loan Comparisons – Examples of Pricing and Restrictions

The OCCC licenses four types of installment loans a consumer might turn to in the case of an unexpected $1,000 – $2000 expense.

15 CAB APR is estimated from fees reported to the OCCC in 2023 Q2 Data reports. 16 10 U.S. Code §987 restricts loan terms to members of the military, including an “all-in” APR limit of 36%. Not all 342-E loans are eligible, but are the most likely option.

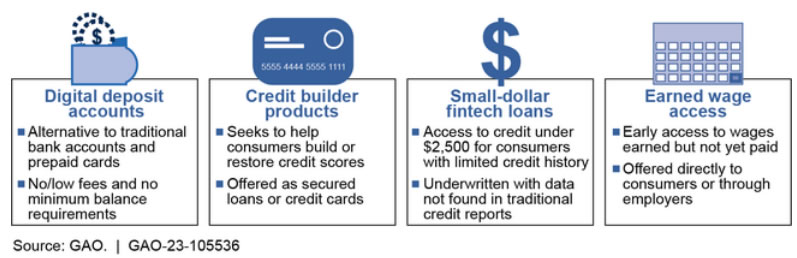

Emerging Products and Innovation

The OCCC is monitoring several emerging financial products.

These products contain possible benefits and expanded access to customers but also possess some regulatory uncertainty.

If the products or providers don’t perform, then the customer risks having few options for corrective assistance.

A 2023 Government Accountability Office (GAO) report highlighted several innovative products marketed to underserved and unbanked populations.

The report highlighted potential benefits such as lower costs and increased access compared to alternatives such as payday loans.

Highlighted risks include a lack of full transparency related to product fees and features.

Additional risks to banking partners (an integral source upon which many innovative products rely) are due to fair lending concerns, lack of FDIC insurance for fintech deposit accounts, 3rd party fraud, and anti-money laundering compliance.

Link to Texas OCCC Report Ending 12/2023: https://geni.us/TexasOCCC2023